CBP 5106 2000 free printable template

Show details

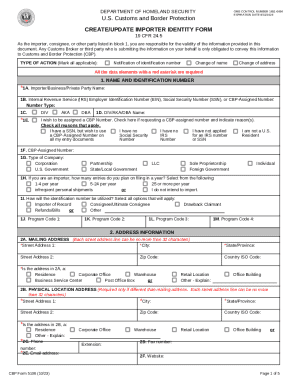

DEPARTMENT OF THE TREASURY UNITED STATES CUSTOMS SERVICE 1. Approved through 12/31/95. OMB NO.1515-0191 See back of form for Paperwork Reduction Act Notice. Type of Action (Mark all applicable) Notification

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your cf5106 2000 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cf5106 2000 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cf5106 2000 form online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cf5106 2000 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

CBP 5106 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out cf5106 2000 form

How to fill out cf5106 2000 form:

01

Start by carefully reading the instructions provided with the form. Make sure you understand all the requirements and have all the necessary information and documents.

02

Begin by entering your personal information in the designated fields. This may include your name, address, date of birth, social security number, and other relevant details.

03

Proceed to fill out the sections related to your financial information. This may include details about your income, assets, and liabilities. Be sure to provide accurate and up-to-date information.

04

Complete any additional sections or questions that are applicable to your specific situation. This could include information about dependents, deductions, or any other relevant details.

05

Double-check all the information you have entered before submitting the form. Ensure that there are no errors or missing data.

Who needs cf5106 2000 form:

01

The cf5106 2000 form is required by individuals or entities who need to report their financial information for a specific purpose. This could include individuals applying for loans, grants, or financial assistance, as well as businesses or organizations reporting their financial data for regulatory or compliance purposes.

02

It may also be necessary for individuals or organizations involved in legal proceedings, such as court cases or divorce settlements, to fill out and submit the cf5106 2000 form.

03

It is important to consult the specific instructions or guidelines associated with the cf5106 2000 form to determine if it is required in your particular situation.

Fill form : Try Risk Free

People Also Ask about cf5106 2000 form

Who needs to fill out form 5106?

How do I fill out CBP form 5106 as an individual?

What is cf5106 form for US customs?

Who completes CBP Form 5106?

Who completes CBP form 5106?

Who needs to fill out Form 5106?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cf5106 form?

Unfortunately, I couldn't find any specific or relevant information regarding a "cf5106 form." It is possible that the form number you mentioned may not be widely known or recognized. If you could provide more context or details about the form, I might be able to assist you further.

Who is required to file cf5106 form?

The CF5106 form is required to be filed by individuals who want to apply for a refund or remission of certain customs duties, Value-Added Tax (VAT), or excise taxes paid on imported goods.

How to fill out cf5106 form?

To fill out the CF5106 form, follow these steps:

1. Begin by entering the case or claim number in the designated field at the top of the form.

2. Fill in the name of the court where the case is being filed.

3. Provide the name of the claimant or petitioner and their attorney, if applicable.

4. Next, enter the name of the respondent or defendant and their attorney, if applicable.

5. Specify the type of case (e.g., civil, criminal, family, etc.).

6. Indicate the reason for filing the form by selecting the appropriate checkbox(es).

7. If applicable, enter the date of the incident or alleged offense.

8. Provide a detailed explanation of the cause of action or incident in the designated space.

9. In the next section, provide a concise statement of how the case should be resolved or what relief is sought.

10. Attach any relevant documents or evidence supporting the claim, if required.

11. Enter the date when the form is being completed.

12. Finally, sign and date the form.

Make sure to carefully review the filled-out form for accuracy and completeness before submitting it to the appropriate court or authority. It is often advisable to consult an attorney or legal professional for guidance when filling out legal forms.

What is the purpose of cf5106 form?

The CF5106 form is used by the Internal Revenue Service (IRS) to request additional information from taxpayers regarding their tax return. It is generally used when the IRS requires clarification or documentation related to specific deductions, credits, income, or expenses claimed by the taxpayer. The purpose of the form is to gather necessary information in order to accurately assess the taxpayer's tax liability and ensure compliance with tax laws.

What information must be reported on cf5106 form?

The CF5106 form is used to report the acquisition, possession, and/or use of hazardous substances and mixtures that are considered to be controlled substances under the Control of Substances Hazardous to Health (COSHH) Regulations in the United Kingdom. The form requires the following information to be reported:

1. Company information: Name, address, and contact details of the company submitting the report.

2. Substances and mixtures: Detailed information about the hazardous substances and mixtures being acquired, possessed, and/or used. This includes the official name(s) or trade name(s) of the substances, as well as any hazard classifications and associated risks.

3. Quantities: The quantity of each hazardous substance or mixture acquired, possessed, and/or used, specified in their respective units of measure.

4. Purpose: The reason for acquiring, possessing, and/or using the hazardous substances or mixtures, such as for production processes, research and development, or maintenance activities.

5. Storage and handling: Details on how the hazardous substances and mixtures are stored and handled, including any specific precautions or control measures in place to minimize risks to health.

6. Exposure assessment: A description of the activities or tasks involving the hazardous substances or mixtures, and the estimated number of workers potentially exposed to them.

7. Risk control measures: Information on the measures taken to prevent or control exposures to the hazardous substances or mixtures. This may include engineering controls, personal protective equipment, or other administrative measures.

8. Monitoring and health surveillance: Details regarding any monitoring or health surveillance activities conducted to assess potential risks and safeguard the health of workers.

9. Emergency procedures: A summary of the emergency procedures in place, including spillage or release protocols and contacts for emergency response.

The CF5106 form is part of the COSHH regulatory requirements, aiming to ensure the safe handling, use, and control of hazardous substances and mixtures in the workplace.

How do I modify my cf5106 2000 form in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your cf5106 2000 form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an electronic signature for the cf5106 2000 form in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your cf5106 2000 form.

Can I edit cf5106 2000 form on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as cf5106 2000 form. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your cf5106 2000 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.